As technology advances, the world has become smaller. Many of us need to get money from one country to another – whether for business or personal needs.

International money transfer companies like OFX make it much more convenient and secure to make these sorts of cross-border transfers. In a space once dominated by banks, OFX offers a fantastic alternative!

Table Of Contents

Pros of OFX

- It’s easy to sign up for an OFX account

- Sending money is extremely simple

- OFX is regulated, trusted, and secure

- Sending money with OFX is cheap

- Low minimums, no maximums

- Great feedback on the OFX mobile app

- OFX accepts various funding methods

- Support on OFX is never far away

- Unusual option to transfer via 24/7 telephone

- Can help companies handle international payroll

- Different transfer types to suit different needs

Cons of OFX

- Phone call verification just for signing up

- Limited transfer funding options

- Minimum transfer amount

- Complaints of funds not reaching destinations

- Occasionally slow transfer speeds

The Workings of OFX Money Transfer

Verdict

We’ll be investigating its pros and cons to help you decide if OFX is a good fit for you.

OFX Overview: Understanding The Basics

OFX is one of Australia’s biggest non-bank Foreign Exchange (FX) providers. It was established in 1998 by two FX professionals from Sydney and focuses on providing a cost-effective alternative to traditional FX services.

Some may view non-bank institutions handling money as being slightly suspicious. However, OFX is certainly legitimate. The company went for listing on the Australia Securities Exchange (ASX) in 2013 and today has a market capitalization of over RM1224 million.

With over 20 years of experience in the money market, OFX now handles over 55 currencies through 115 registered global accounts.

Who Should Use OFX?

As I’ll explain in a second – if you’re using OFX, it is best to transfer in larger amounts so that you won’t need to pay any transfer fees. It’s also ideal for sending substantial sums since there isn’t any upper-limit restriction.

Folks who may find OFX useful include:

- Companies with remote teams

If you need to pay remote staff regularly, OFX is one of the best options. Their payment setups let you leverage excellent rates and low fees to get the best bang for your buck.

- Parents with kids studying overseas

For anyone with kids attending college or university further from home. OFX lets you send money to them conveniently, plus removes expensive bank fees.

- Those who work with freelancers

Thanks to lower minimum transfer amounts, OFX is now a good choice for those needing to pay freelancers for their services.

11 Things We Really Like About OFX

1. It’s Easy To Sign Up For An OFX Account

To make any transactions on OFX, you’ll need to register for an account. The process is entirely free and the essential factor here is how streamlined they’ve managed to make the process.

One of the things that people hate about banks is the amount of red tape. Today, banks are even imposing restrictions and limitations on who can open various accounts and demand bigger and bigger minimum deposits.

Thankfully with OFX – the sign-up process is concise and straightforward. At the same time, they balance things with some verifications to ensure they meet security standards.

To understand how this works, let’s take a look at the 3-step process that needs to happen;

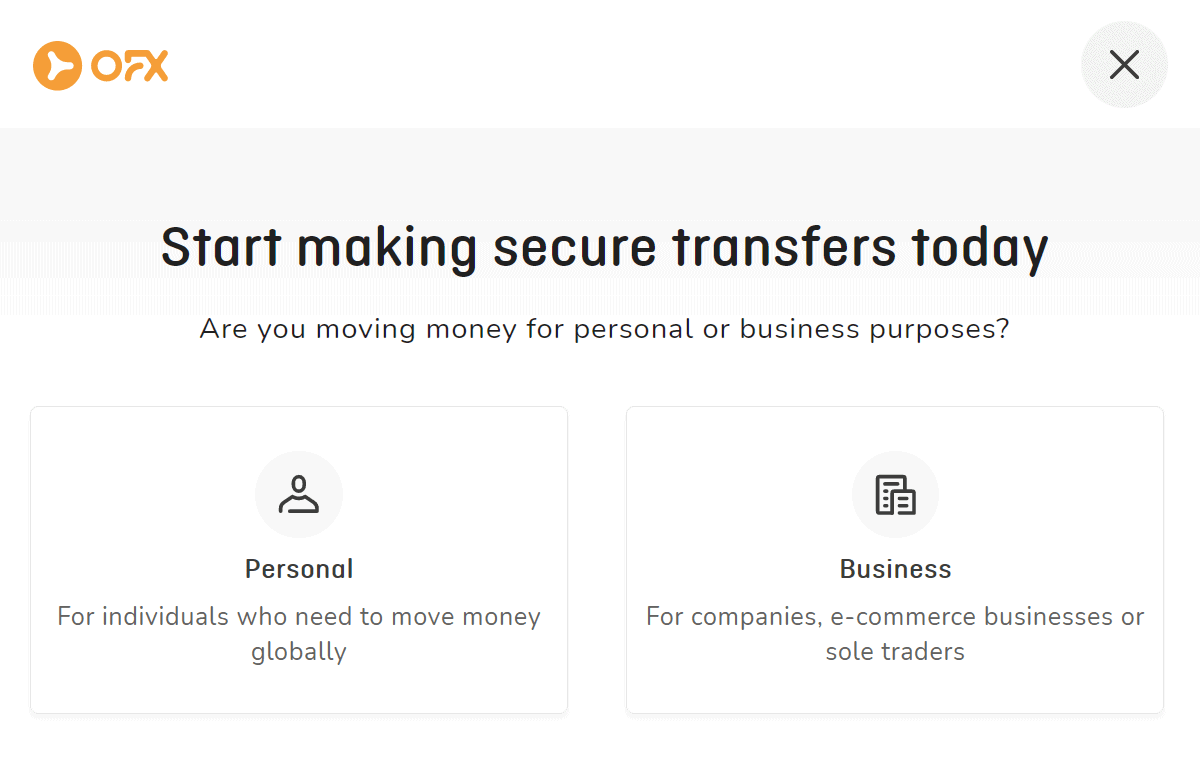

Step #1. Choose your account type

First, register on the website and select the type of account you want to open. It can be either a personal or business one.

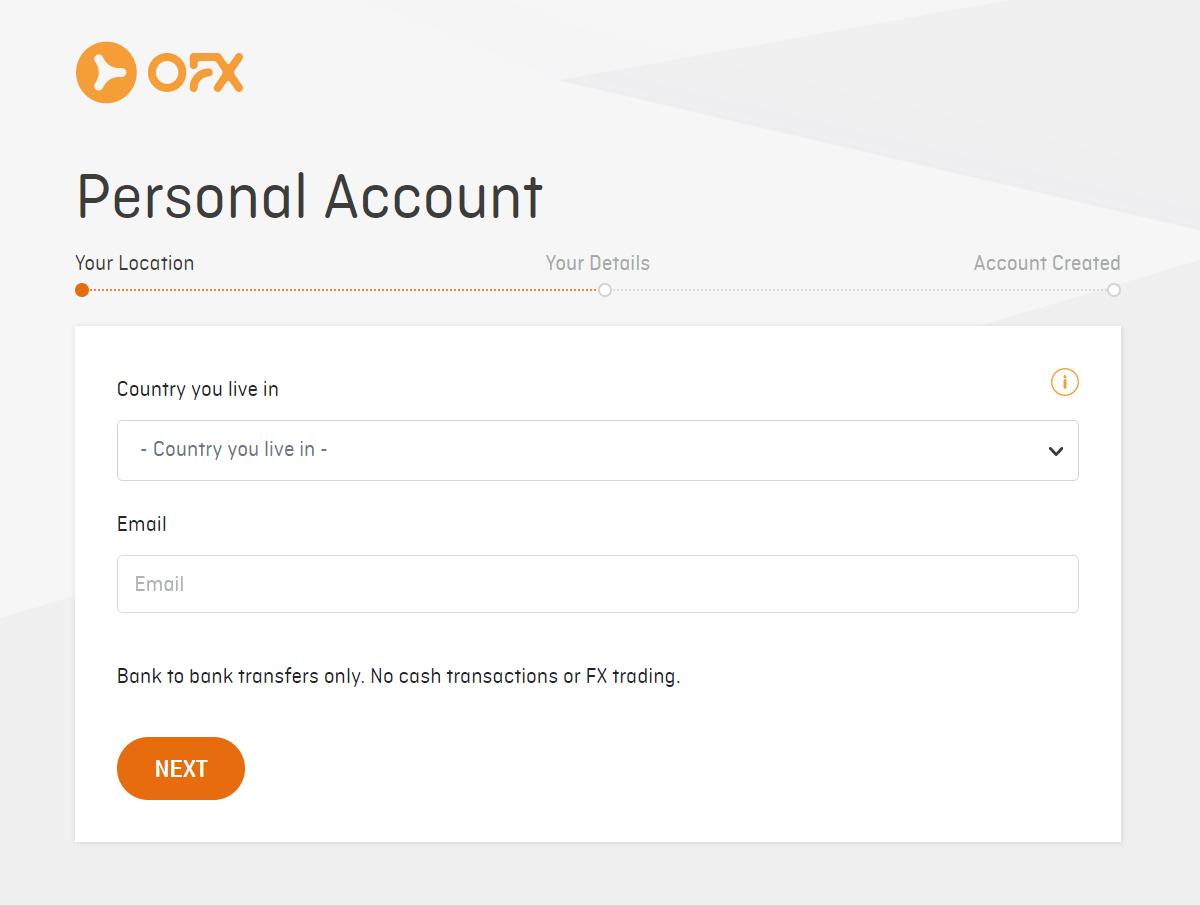

Step #2. Fill in some personal details

Next, fill in some basic details. This is one of the best parts of OFX. They won’t question you excessively. Most of the detail that needs to be completed falls under the name, address, contact number categories.

Step #3. Verify your identity

Once your registration is complete, you’ll need to undergo your identity verification via a phone call. Such a step is for security purposes. They’ll then verify your identity, location, and bank account information.

In some circumstances, you may need to provide proof of identity documents (photo identification such as a passport or driver’s license, along with proof of address such as a bank or utility statement).

2. Sending Money Is Extremely Simple

Once your OFX account is active, you’re ready to get down to business and make your first transfer.

It may sound a bit more complicated than it is though, so we’ve broken it down into a few distinct steps:

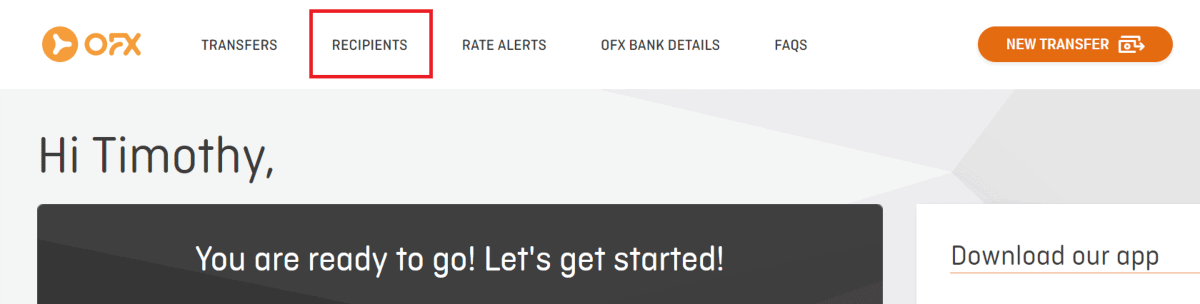

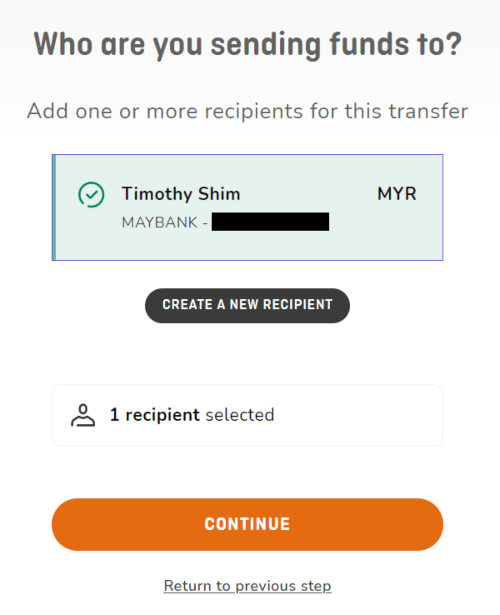

- Log in your OFX account and look for the “Recipients” tab. Fill in the needed recipient bank details and save the profile.

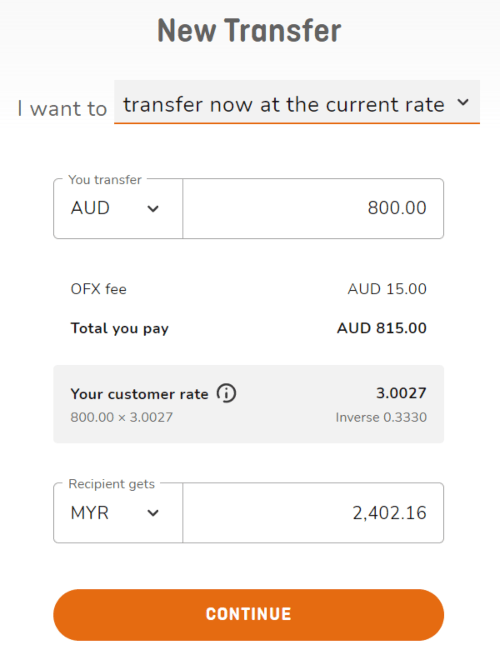

- Go to the “New Transfer” tab and choose the currencies to send and transfer in, then key in the amount.

- The exchange rate will then be calculated automatically. If it looks good to you, click “Continue.”

- Select the recipient (this is the recipient profile you set up earlier) and give it a final check. If everything is in order, click “Confirm.”

- You’ll then receive a confirmation email from OFX with the details of your transfer – including OFX’s bank details along with the list of payment options. You can choose to do a domestic transfer to OFX account (OFX uses their Global By Local network to make domestic transfers in order to help you save on exchange rate margins).

Once you have made the payment, OFX will proceed with the transfer to your intended recipient.

You can track progress via the website or with the OFX app. You will also receive email updates throughout the whole process. In all – making transfers felt very straightforward.

• Zero OFX fees & direct debit available.

• No subscription or minimum balance required.

3. OFX Is Regulated, Trusted, And Secure

OFX has been around for a long time and is a public listed and regulated company. Their official recognition spans the globe, with registrations from Canada to Singapore. The company holds a Money Laundering Regulation Certificate, which aids with anti-money laundering laws that apply to the countries where they operate.

Regarding the security of your money, OFX has insurance against any sudden cases of bankruptcy. So in case of disaster, you should get your money back. Their operational and customer funds are kept separate, so nothing overlaps for better transparency.

Even their website is secure, thanks to the use of encryption and a system of identity verifications. They even introduced two-factor authentication (2FA) through SMS as an additional layer of security.

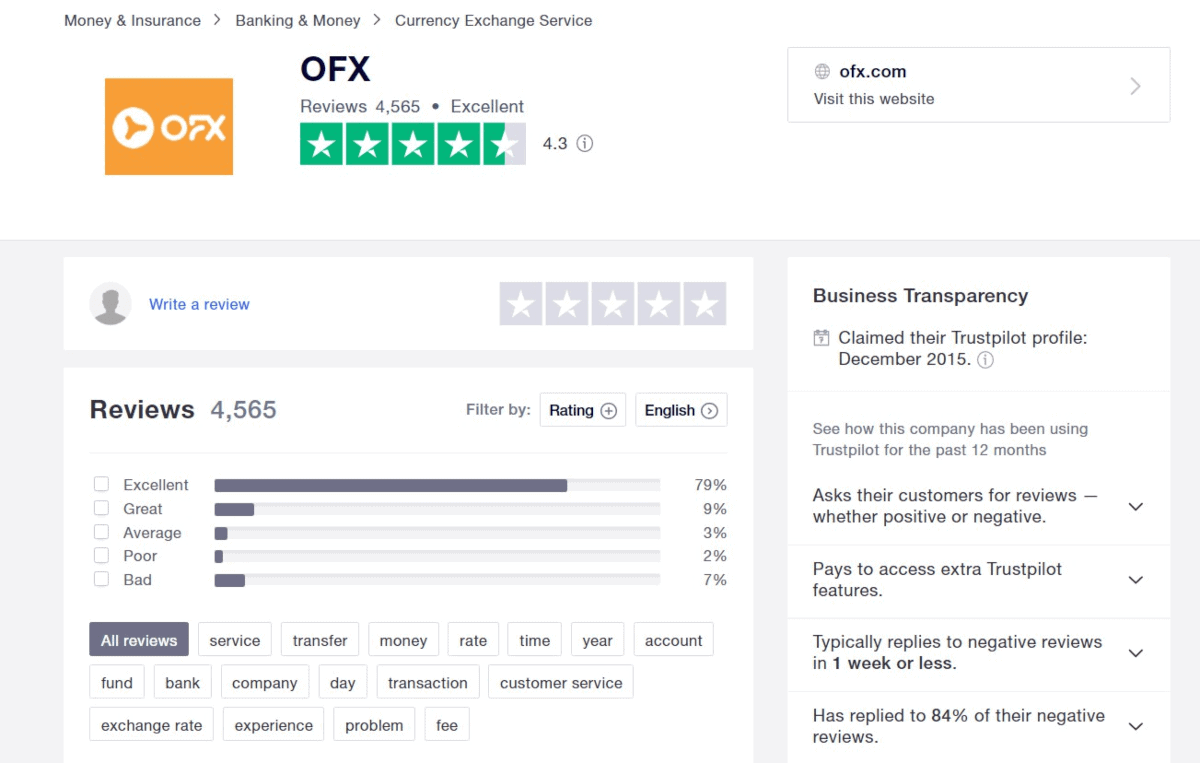

All of this works in OFXs’ favor. They have a solid 80% “Excellent” rating on Trustpilot. It’s a highly positive sign of their professionalism and ability to help folks out.

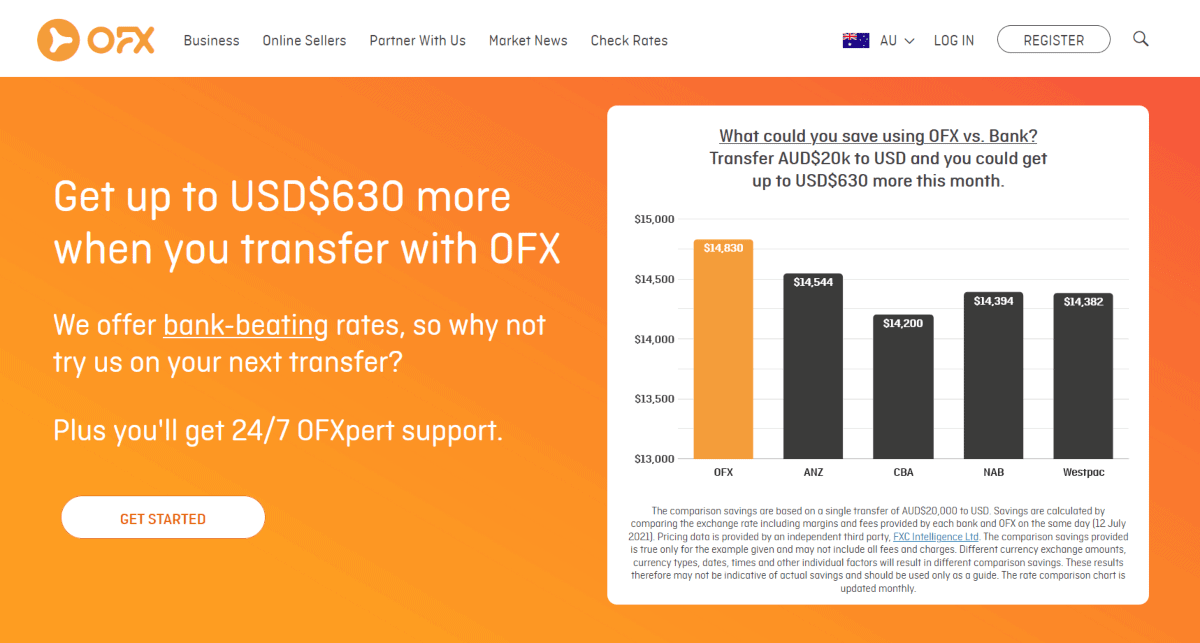

4. Sending Money With OFX Is Cheap

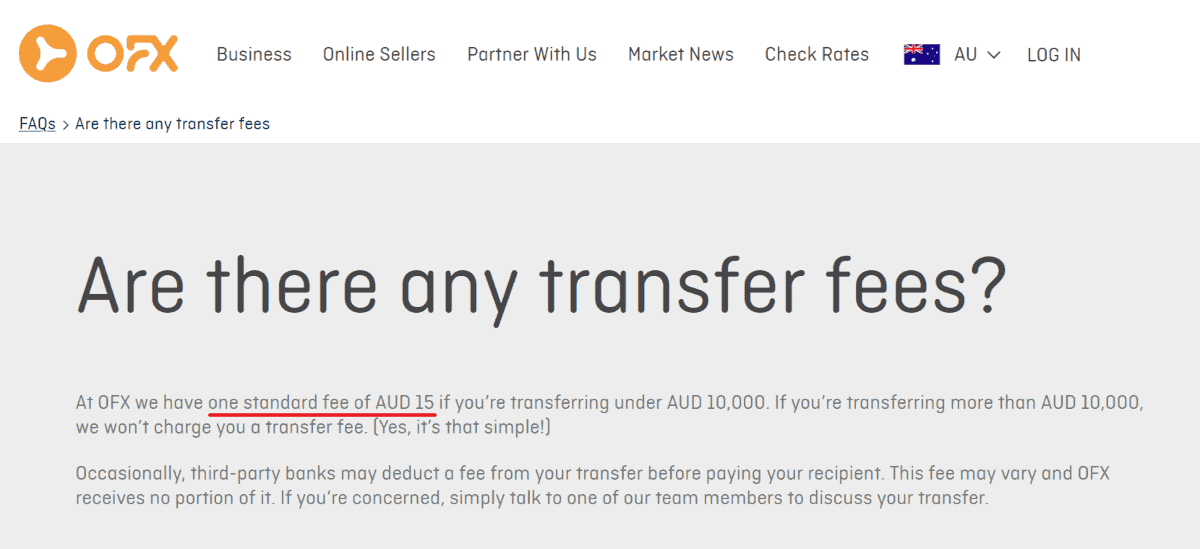

OFX does not charge any setup fees or monthly account fees – even registering for an account costs nothing.

Each time you perform a transfer, it earns money by taking a small percentage – usually less than banks charge. There’s one thing to keep in mind about the fees, though. Some third-party banks may deduct a fee from the transfer during the transfer process before handing the money to your intended recipient. That’s unavoidable, and the money doesn’t go to OFX.

At OFX, a standard fee of RM49.50 applies if you transfer less than RM33277.50. Any amounts above that are sent fee-free.

The best part of the way they price transfers is that OFX utilizes mid-market rates. This rate is a “wholesale rate” usually available only to banks. Banks charge you what’s called a “retail rate”, which means you lose out a lot on each transfer.

In short – OFX gets you a much better deal.

5. Low Minimums, No Maximums

OFX recently lowered its minimum transfer amount to RM828, giving you more flexibility in making global transfers. Also, you’d be glad to know that you can send as much as you need to, and there’s no upper limit to this amount.

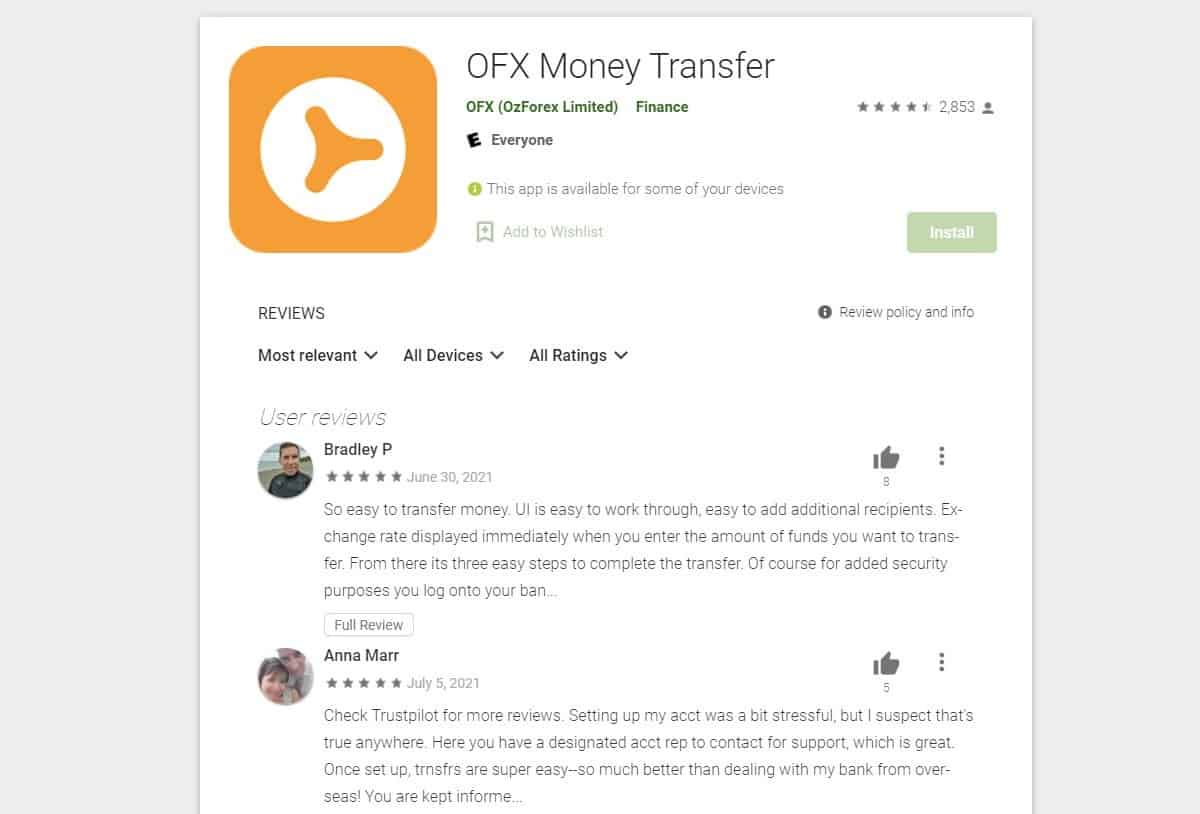

6. Great Feedback On The OFX Mobile App

The OFX mobile apps support iOS v7 and above and Android Honeycomb (version 3.0/API Level 1) and above. It’s as full-featured as their desktop browser experience so that you can access all currency exchange information and services from the convenience of a mobile device.

If that doesn’t impress you, here’s a recap of the many things you can do;

- Initiate single transfers

- Track your transfers

- Access and view live exchange rates

- Manage – create, view and edit existing recipients

- View daily and weekly foreign exchange news

- Set rate alerts

7. OFX Accepts Various Funding Methods

Although the funding options are restricted to your bank account only, OFX still gives you some different options within this, which is great.

These include:

- Domestic Funds Transfer

- Electronic Funds Transfer

- BPAY (an electronic bill payment system in Australia). This method is only available if you’re transferring money from within Australia.

- Direct Debit

This flexibility in how you fund your transfers can come in really handy.

• With 50+ currency supported and one standard transfer fee!

• No subscription or minimum balance required.

8. Support On OFX Is Never Far Away

There’s always the odd chance something may go wrong, or you have questions. In cases like this, you’ll find a very detailed and comprehensive knowledge base helpful for first-line assistance.

Additionally, OFX offers 24/7 customer support via telephone and email. The constant availability makes it even better for businesses in any location since you won’t have to worry about support hours.

9. Unusual Option To Transfer Via 24/7 Telephone

Many digital services face one problem: they are mostly the domain of younger, more tech-literate folks. That sadly means that many of them are just out of reach for a specific market segment.

OFX however, clevely sidesteps this by allowing 24/7 phone-based transfers!

Typically, even banks will give you lots of problems if you try to make transfers via phone. Other money transfer services seem to frown on it as well, making the OFX 24/7 phone transfer service a real diamond in the dark.

10. Can Help Companies Handle International Payroll

Earlier, we mentioned that OFX offer both personal and business accounts. The distinction becomes clear if you need to handle payroll for a global workforce.

OFX business accounts have additional features targeted at small and medium-sized businesses. They specialize in international payroll support, allowing you to pay up to 500 employees at a time – anywhere around the world!

You can even integrate those services with third-party accounting software, making it fit in neatly with regular operations.

11. Different Transfer Types To Suit Different Needs

OFX offers a pretty diverse range of bank transfer service options. The variety means they can easily cater to the needs of a wide variety of users and circumstances.

- Single Transfers

One-off transfers from one currency to another, at the current available rate.

Great for: Anyone needing to make overseas transfers.

- Recurring Transfers

Continual payments. You’ll set up the transfer schedule, and OFX manages the rest. OFX allows you to schedule up to 12 months at a time, and you can also set up a fixed payment plan that locks in the current exchange rate for all transfers.

Great for: Anyone needing to make regular overseas transfers.

- Marketing Order

This lets you set a target exchange rate that you would like to transact but not immediately. Once they can meet your set target rate, OFX will initiate the fund transfer.

Great for: Anyone who needs to make a transfer, but isn’t in a hurry. It will help you save on the exchange rate.

- Forward Contract

You can set up future transfers on set dates, up to 12 months later at a current agreed-upon exchange rate. That locks in the current rate, which will be valid for all the transfers set for that forward contract.

Great for: Protecting you against the risks and uncertainties associated with adverse exchange rate movements.

- FX Option

Opting for this gives you the right (but not the obligation) to make your transfer at a specific time and predetermined exchange rate. You simply need to pay an up-front premium to activate this option.

Great for: Helps you safeguard your transfers against adverse shifts in exchange rates.

• No subscription or minimum balance required.

What We Didn’t Like About OFX

1. Phone Call Verification Just For Signing Up

While we found the whole sign up process to be straightforward, the step that required OFX to call us for verification purposes just to create an account did put a tiny bump on the whole process.

Yes, it is a great security measure, but was a call a necessity? We couldn’t help but feel somewhat restricted – and this was just for account creation.

2. Limited Transfer Funding Options

Unlike many others, OFX has limited transfer funding options as it only accepts transfer funding via your bank account. This restriction means that you have fewer choices regarding how you want to make the payment to OFX.

Other service providers like Wise often have a broader funding range, such as cash, check, or a credit/debit card. Also, the recipient can receive money in their bank account only.

3. Minimum Transfer Amount

OFX requires you to set up an account to see the actual rate you’ll have to pay. Compared to this, Wise offers an online calculator that computes your rates upfront without the need to sign up for an account. The difference is remarkable, and the OFX way could be a stumbling block for many.

OFX also has a minimum transfer amount of RM832.50 when making transfers. While this isn’t a high minimum, it is yet another restriction to keep in mind.

4. Complaints Of Funds Not Reaching Destinations

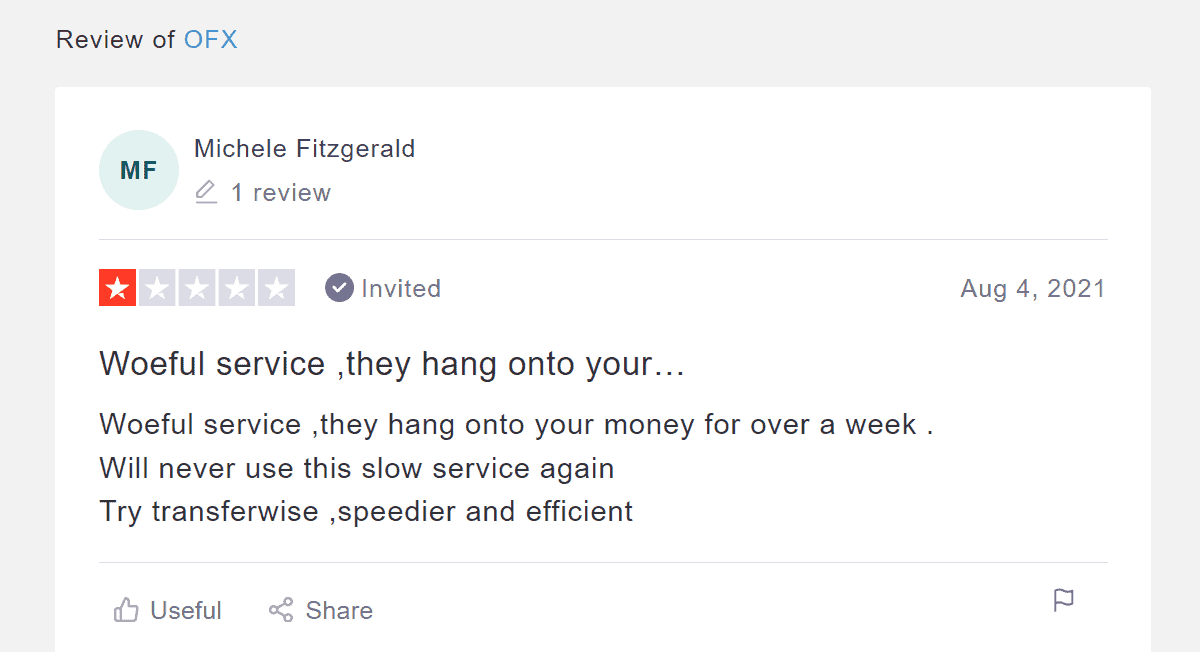

While the reviews were generally positive, there was a percentage of users who left terrible ratings. One reason for some of those ratings stood out; that OFX delayed or even lost transfers. Other complaints included unnecessary holds on funds or simply an overall poor user experience.

Funds not reaching the destination seems to be quite a common complaint when it comes to OFX. This issue usually lies with the banks where the money has gone and not the fault with OFX as the relevant banks are still processing the transaction. Unfortunately, you may get conflicting information from OFX at such times, which can be downright frustrating.

The problem is that OFX does not consider the processing time in the receiving bank accounts.

That said, this isn’t always the case.

5. Occasionally Slow Transfer Speeds

In general, it could take around 3 – 5 business days for your money to reach the recipient. This speed may be typical, but other services in the market have spoiled customers with much faster services.

The Workings Of OFX Money Transfer

Understanding How OFX Works

OFX is known for convenience and the lower fees it charges compared to traditional banks. Many things help them achieve this level of service. For example, the omission of having many physical outlets helps them reduce operational costs.

Most importantly, though, is how they manage money transfers.

What Makes OFX Different?

OFX can provide better fees and lower markups on their exchange rates due to a different business model used.

Banks and other money transfer services buy foreign currency at a price close to the mid-market rate. They will then sell this currency to you for a higher rate, taking a margin in between called the “spread”. There are also often transaction fees which can vary between banks (but hovers at around 5%).

OFX’s lower operational costs allow it to offer more competitive exchange rates. They also encourage you to move funds in bulk, omitting fees for higher value amounts.

Would We Use OFX Money Transfer? Absolutely

Being an international money transfer services provider for more than 20 years, OFX has proven to be an excellent choice for most. They have a great range of features and services that make them a solid choice for individuals and business customers.

Also, their ability to accept transfers and provide customer service around the clock is impressive, and their low rates are very appealing. On top of that, you won’t have to sacrifice quality of service to save money!

Despite some of the few minor inconveniences that OFX has, it is still a dependable method to accept payments online or send funds overseas.

Key Features

- ✓ Flexible funding

- ✓ Customised rates

- ✓ Bank beating rates

- ✓ 24/7 OFXpert support

- ✓ 2-factor authentication

- ✓ Support 50+ currencies

Recommended For

- • Personal use

- • SME owners

- • Online sellers

- • High-value transfers

• With 50+ currency supported and one standard transfer fee!

• No subscription or minimum balance required.

OFX

From

RM45

monthly